Bedford Metals is devoted to the responsible discovery and development of uranium and gold deposits, prioritizing environmental care, carbon reduction, and cost efficiency.

With a seasoned management team, high-impact uranium and gold projects, and a disciplined share structure, Bedford Metals is well positioned to create shareholder value as it advances a portfolio of standout exploration assets across Canada’s premier mining districts.

Management has extensive experience with uranium companies in the Athabasca Basin, complemented by strong public-markets and M&A backgrounds

The 13,092-hectare Sheppard Lake Project on the southern end of the Athabasica Basin, with newly defined EM conductor zones and multiple uranium prospects

The 687-hectare Margurete Gold Project lies near the Phillips Arm gold camp, featuring past samples grading up to 6.18 g/t Au

The Close Lake Uranium Project lies adjoining claims held by Cameco Corporation on the eastern side of the Athabasca Basin, underlain by conductive targets typical of major uranium discoveries in the eastern Basin

The Sheppard Lake Uranium Project is located on the southern lip of the Athabasca Basin in Northern Saskatchewan, the most productive uranium producing region in the world. The Project covers an area of 13,092 hectares and has several high value exploration targets, including the TZ1, TZ2 and the Warr Lake Zone targets.

Continue Reading

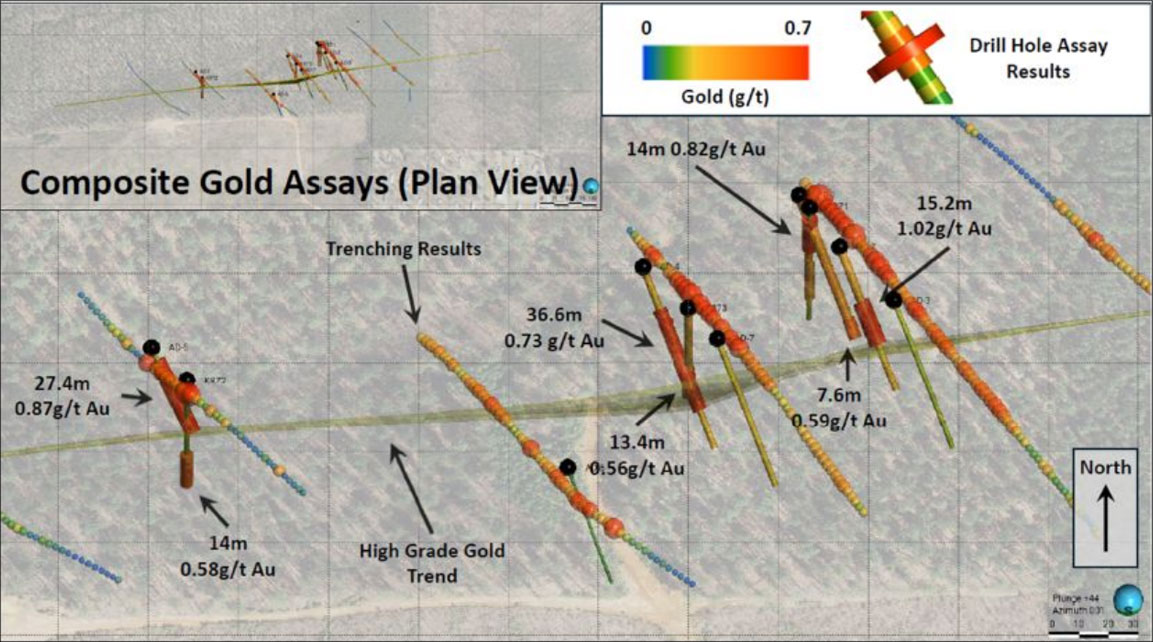

Bedford Metals holds a 100% interest in the Marguerete Gold Project, a 687-hectare property located roughly 200 kilometers northwest of Vancouver in southwest British Columbia. Situated in a historically gold-rich district, the project has benefited from comprehensive exploration since 1986, including advanced geochemical surveys and targeted drilling. This sustained work has positioned the Marguerete Gold Project for the next phase of discovery and value creation.

Continue ReadingThe Close Lake Uranium Project lies on the eastern side of the Athabasca Basin, adjoining claims held by Cameco Corporation, the largest uranium producer in the world. The property is approximately 245 hectares and lies within the primary exploration corridor, which hosts the Keys Lake Mine, the Cigar Lake Mine and the McArthur River Mine. The property is accessible through a network of roads and trails.

Continue Reading

Sign up to receive updates on our latest news and events. Your email will never be shared or sold and you can opt out at any time.

No, I don't want to receive updates